Bankwest

Mobile Credit and Debit Cards: Easy Instalment Balance Plan

AC/DC

I was involved with the Amazing Credit and Debit Cards team at Bankwest during my contract.

Team logo (left) designed by me

How do we help customers pay off credit card debt?

This was the question that I had to solve for as an Experience Designer on this project with Bankwest. Not only was figuring out a solution for customers who had a high revolving credit card debt part of a regulatory requirement in banking that we had an obligation to meet from a legal standpoint, but it was an outstanding issue from a customer viewpoint as well. At Bankwest, it was important to put the customer first and not only ask "How do we do this?" but "Should we be doing this?" as well. Helping customers who struggle financially pay off their debt in a responsible and transparent way was my highest priority. My role was predominantly focused on the UX research and mobile solution and where this would sit within Bankwest's app.

What is an Easy Instalment?

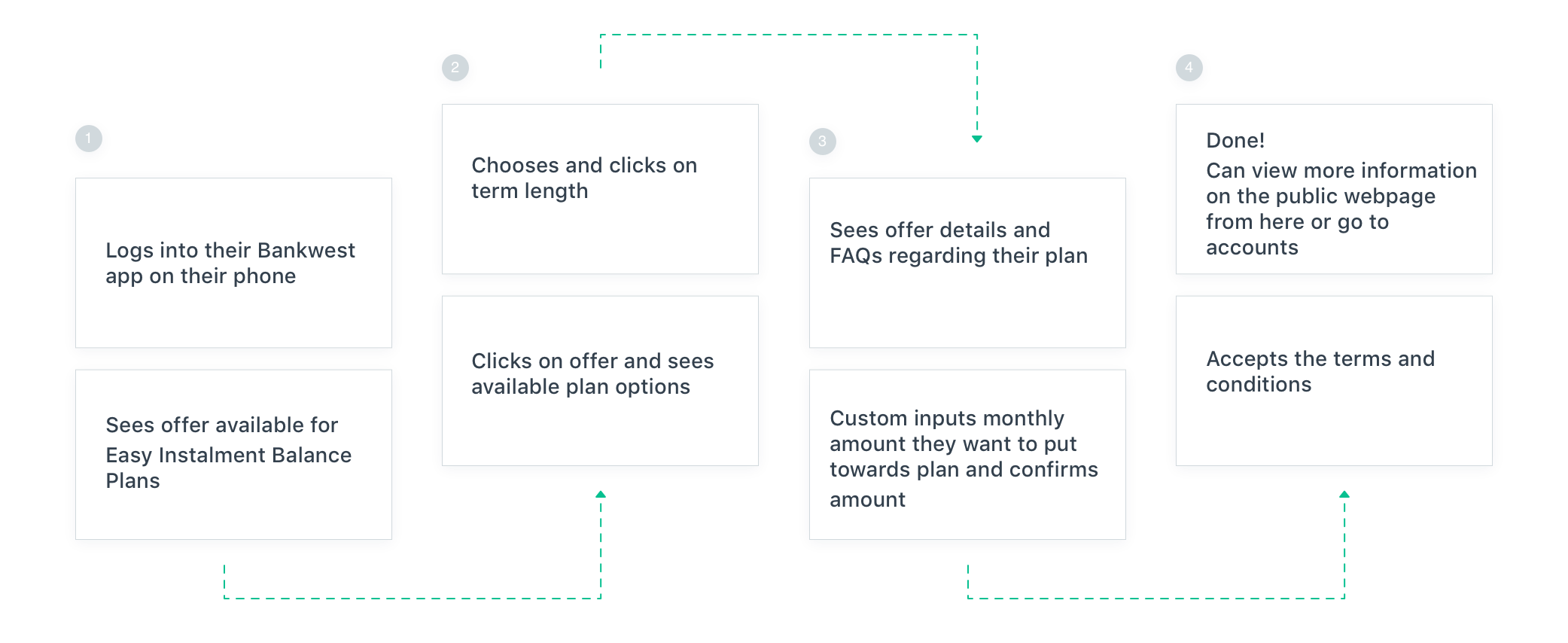

At the beginning of my design process, I created sketches and wireframes to map out the user flow and information architecture.

The starting point with the sketches was focused on discoverability. Where would the customer find out how they could pay down their debts? How do we inform them what this offer even is? What even is an Easy Instalment and how does it benefit me?

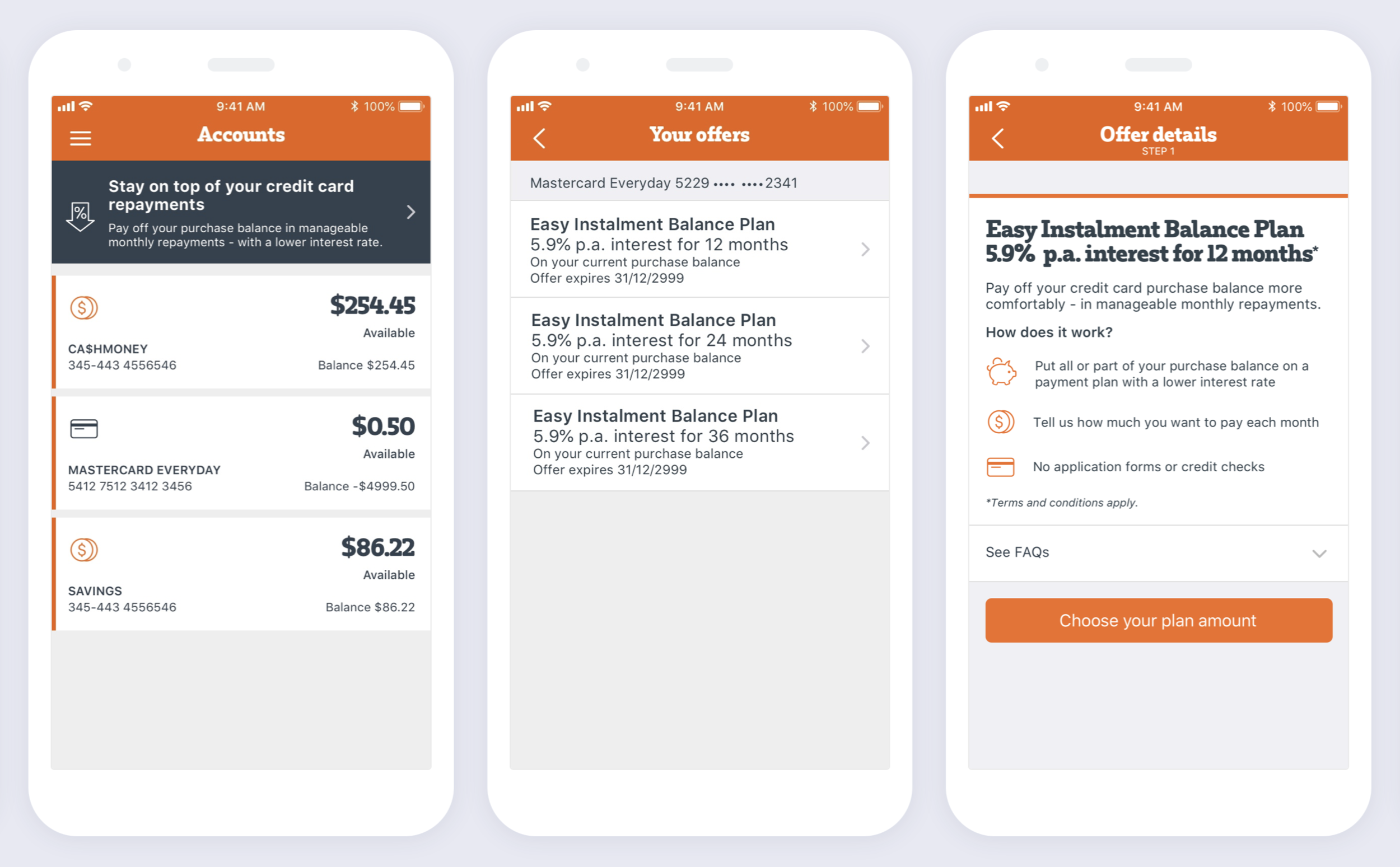

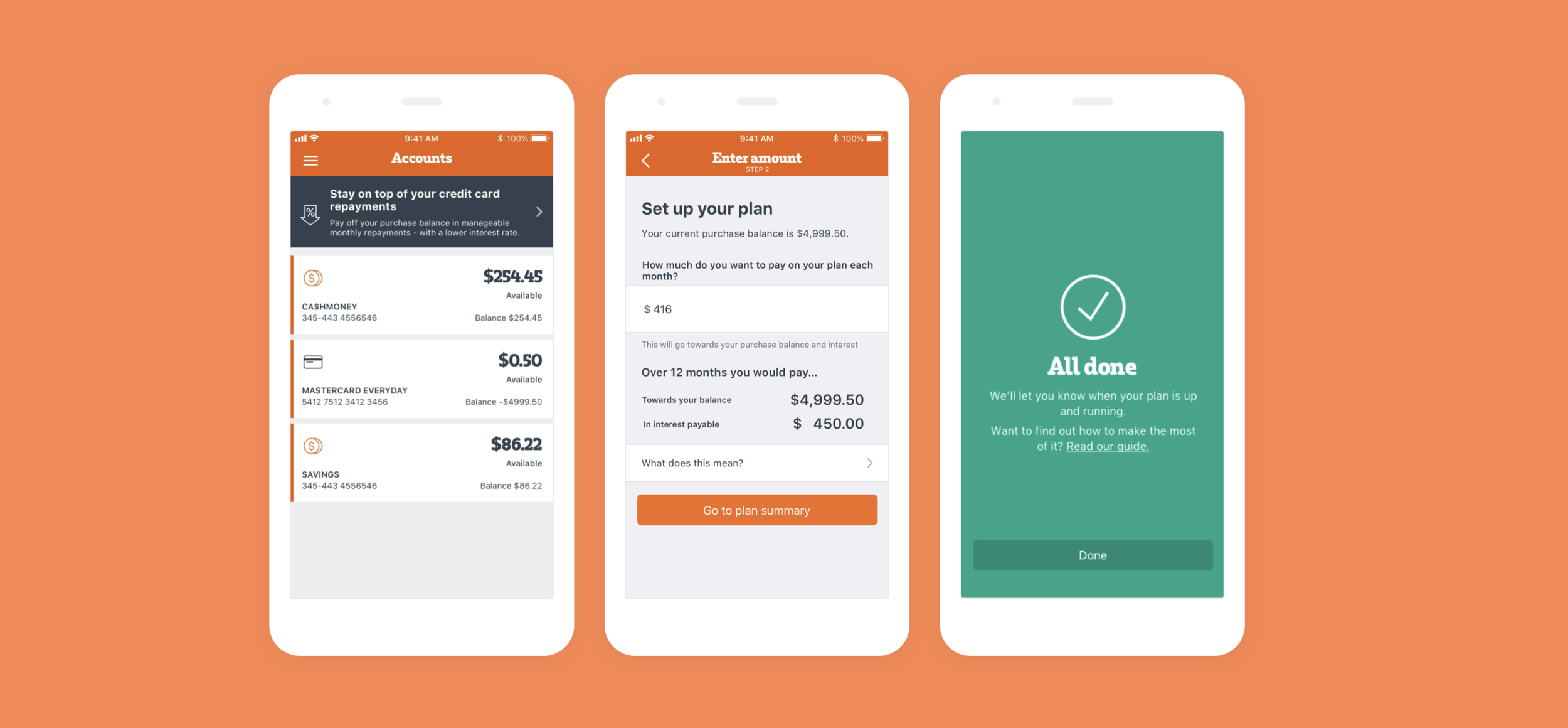

What we came up with was an in-app offer banner that would appear after logging in alerting the customer they had an opportunity available to pay off their debt on their credit card. This offer presented allowed the customer to select a term of up to three years at a much lower interest rate than their current credit card. The customer could select how much they were willing to pay each month towards their purchase balance and a plan was made to help them make these payments every month.

Sketches of the 'Easy Instalments' process

Testing Hypothesis

User Testing

Before launching the product, I've made a testing round in order to reveal possible usability problems.

Phase 1 of the prototypes was designed and a few weeks in I wanted to test to see how intuitive this process was for our customers.

We tested four users, between the ages of 25-54, male and female, who were current Bankwest customers with a credit card who had been offered a balance plan in the past.

The method I used for testing was an in-person approach, letting the user run through the app, asking general questions about each particular screen in the flow and what they thought of the product as a whole.

The tasks I gave each tester were to go through the flow at their leisure and set up a balance plan. Did they know how to get to the offer? Did they understand what the offer was about? Could they set up a plan? Did they see the value of the Balance Plan? Did they understand the Terms and Conditions of the plan? and would they use this product in real life?

The most important feedback from the testing phase ruled that although the customers saw and understood the benefit of an Easy Instalment Balance Plan, the 'Easy' part of the plan was a stretch. Some of the customers, especially those with less financial literacy than others, didn't understand the proper value of the plan and how it could benefit them, they were lost in the financial jargon and felt uneasy with the idea that a bank was proposing a solution to actually rid them of debt without some sort of catch or fine print extra fees or consequences.

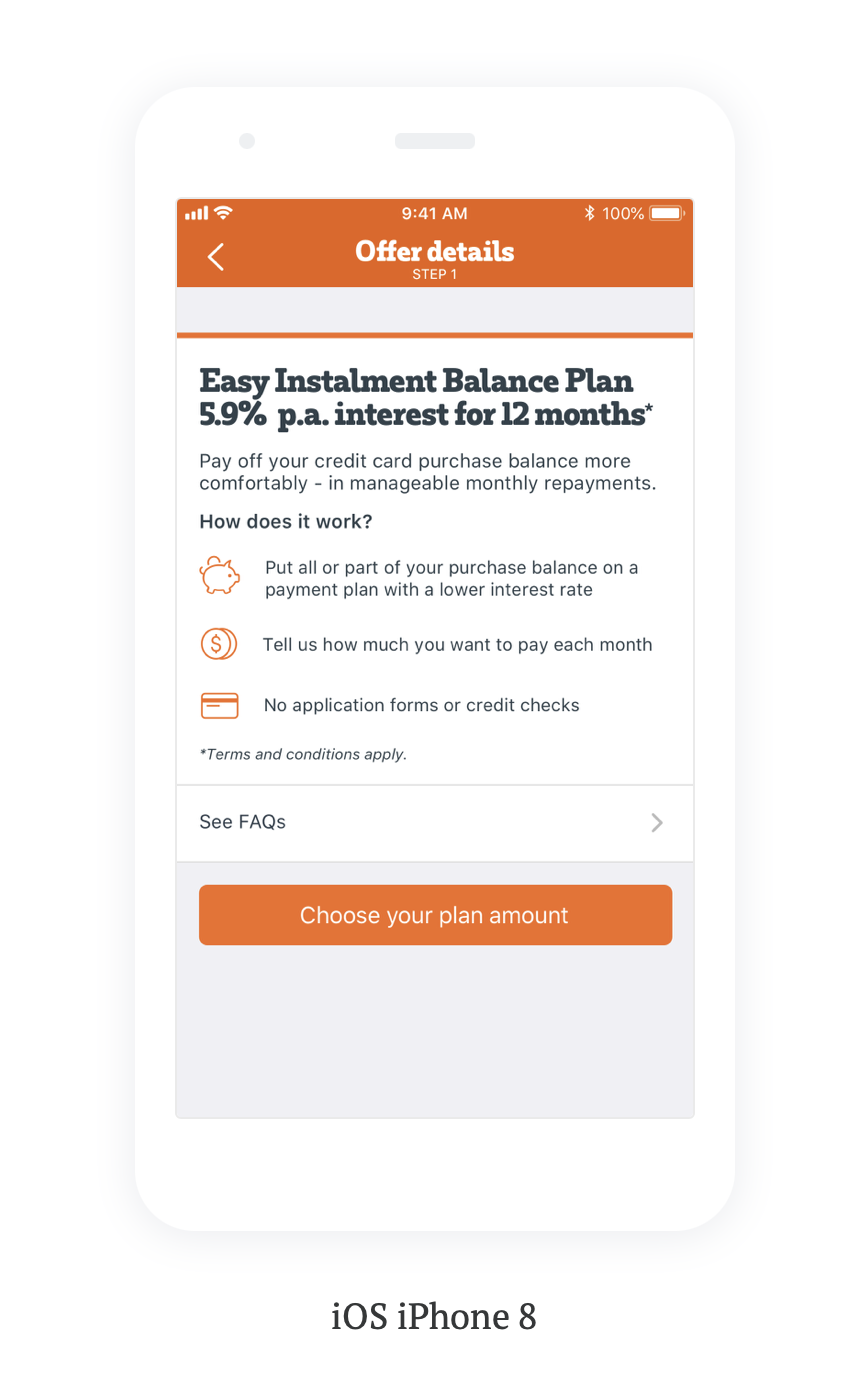

The design changed exponentially from this feedback and more guiding information including FAQs were included to properly educate the customer before they signed up for the plan.

UI Design

Once I tested out all usability mistakes, I started designing the final screens in Sketch.

Make it stand out

I designed an iOS and Android prototype that was bright, fresh, and accessible to users following Bankwest's style guides and meeting regulatory requirements.

““It’s customised to you, tailored to what you can afford and helps you avoid hardship””

What have I learned from this project?

My biggest struggle with this project was first and foremost the education piece behind the product. Even within the bank colleagues struggled to fully grasp what an Easy Instalment was and what was the true benefit to them and the customer. Through several meetings and customer testing, we were able to explain this product in a way that fully did it justice. As a bank, and with a team that works closely with legal, it's easy to get lost in legal jargon. But who really understands everything laid out in the terms and conditions? I didn't. We needed a product that had clear, concise, plain English, and with resources listed out. Just because you work in a corporate setting doesn't mean your product can't be conversational. You don't want customers to feel like they're locked in a scary contract that's trying to trick them, you want them to feel secure, supported and self-sufficient.

This was a product I walked away from truly feeling like we're adding value to a customer's lives. People are busy, they want to set it and forget it and want to trust their bank. With this Easy Instalment Balance Plan not only was the "How can we do this?" piece addressed but the "Should we be doing this?" was a clear yes and it shows.